Economics

Understanding the Supply Curve & How It Works

Learn about what a supply curve is, how a supply curve works, examples, and a quick overview of the law of demand and supply.

Alejandro Diaz Herrera

Subject Matter Expert

Economics

05.26.2022 • 8 min read

Subject Matter Expert

Learn what a perfectly competitive firm is, how they make output decisions, and how they determine the highest profit by comparing total revenue and total cost.

In This Article

A perfectly competitive firm (or a price-taking firm) is a firm that sells its goods or services in a market with perfect competition.

Some important facts about perfectly competitive firms are:

It has no market power and no ability to set prices.

The firm must accept whatever price the interaction of supply and demand sets in the market. This price is called the market price—also called the equilibrium price or the market-clearing price.

So long as a perfectly competitive firm is willing to sell at the market price, the firm can sell any number of units it wishes to sell.

The main output decision for a price-taking firm is the decision of how many goods or services to sell.

To maximize profits, a perfectly competitive firm will choose a quantity where the market price is equal to marginal costs (P* = MC).

For a perfectly competitive firm, the market price is equal to marginal revenue, so the firm’s profit-maximizing quantity is also the point where marginal revenue is equal to marginal cost (MR = MC).

Perfectly competitive firms are sometimes called price-taking firms or price takers because they must take the market price as given. Why is this the case?

In a perfectly competitive market, there are low barriers to entry and numerous firms competing to sell identical or very similar products. The immense amount of competition in the market makes it impossible for any single firm to set its own prices.

To understand this point better, put yourself in the shoes of a perfectly competitive firm selling wheat in a market where the equilibrium price is $10. Ask yourself these two questions.

First, do you have any incentive to charge a price below the market price? The answer is no. Why sell a bushel of wheat for $7 when you know you can sell it for $10?

Second, with all the competition in the market, are you able to charge a price higher than the market price? Again, the answer is no. If you raise your price above the market price, all of your competitors will undercut you and no consumer will buy your products.

Why would a consumer buy a bushel of wheat for $15 from you when they know that other sellers in the market are selling an identical product for $10 per bushel?

In short, it is the extreme rivalry between firms in a competitive industry that makes perfectly competitive firms price takers.

A perfectly competitive firm has one major output decision to make: how much (or what quantity) of their good or service to produce. To see why this is the case, we need to take a closer look at the definition of profit.

Like most firms, a perfectly competitive firm seeks to maximize profits. Profits are equal to total revenue—the money the firm takes in from its customers—minus total cost—the total cost of producing the units of output being sold. We can further break down total revenue and written price times the number of goods sold, while total costs are equal to the average cost of the units sold times the number of goods sold.

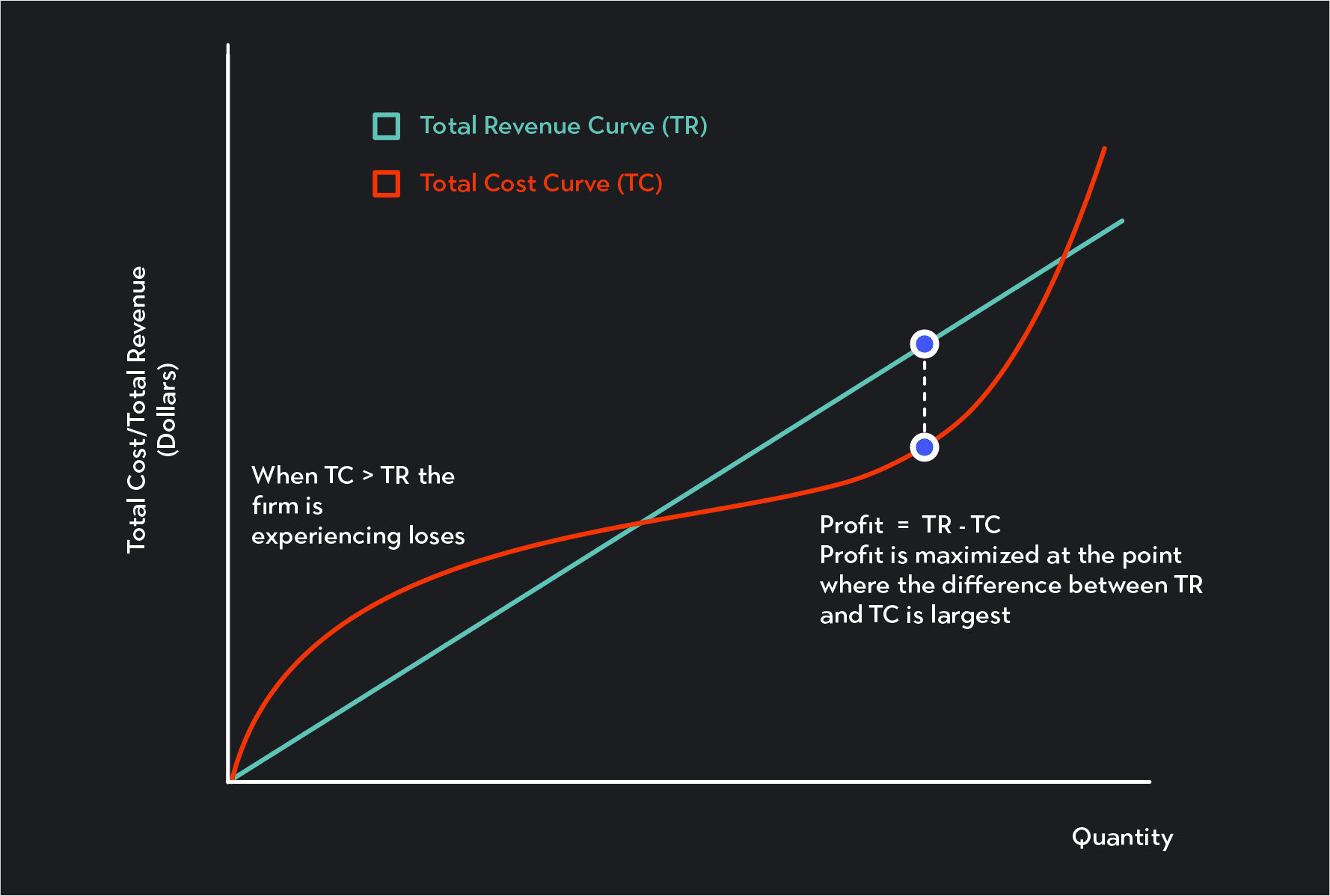

As a price taker, a perfectly competitive firm has no control over the price it can charge, so the only way it can affect profits is by adjusting output. Increasing profits, however, is not as straightforward as simply ramping up production. Notice that as quantity increases total revenue increases, but so do total costs. As quantity decreases, total revenue decreases, but so do total costs. To maximize profits, the firm chooses a quantity that maximizes total revenue minus total costs.

A firm’s total cost curve and total revenue-- The vertical axis is measured in dollars, and the horizontal axis shows the quantity produced. Profit maximization occurs where the vertical distance between the total revenue curve (on the top) and the total cost curve (on the bottom) is the greatest. If the total cost curve lies above the total revenue curve, the firm’s costs are greater than its revenues (i.e., the firm is experiencing losses).

The number of units that the firm produces is the quantity that maximizes the difference between total revenue and total cost. That is, the firm chooses the quantity that maximizes profits given the market price. For a price-taking firm, this profit-maximizing quantity occurs at the point where the market price is equal to the marginal cost of production.

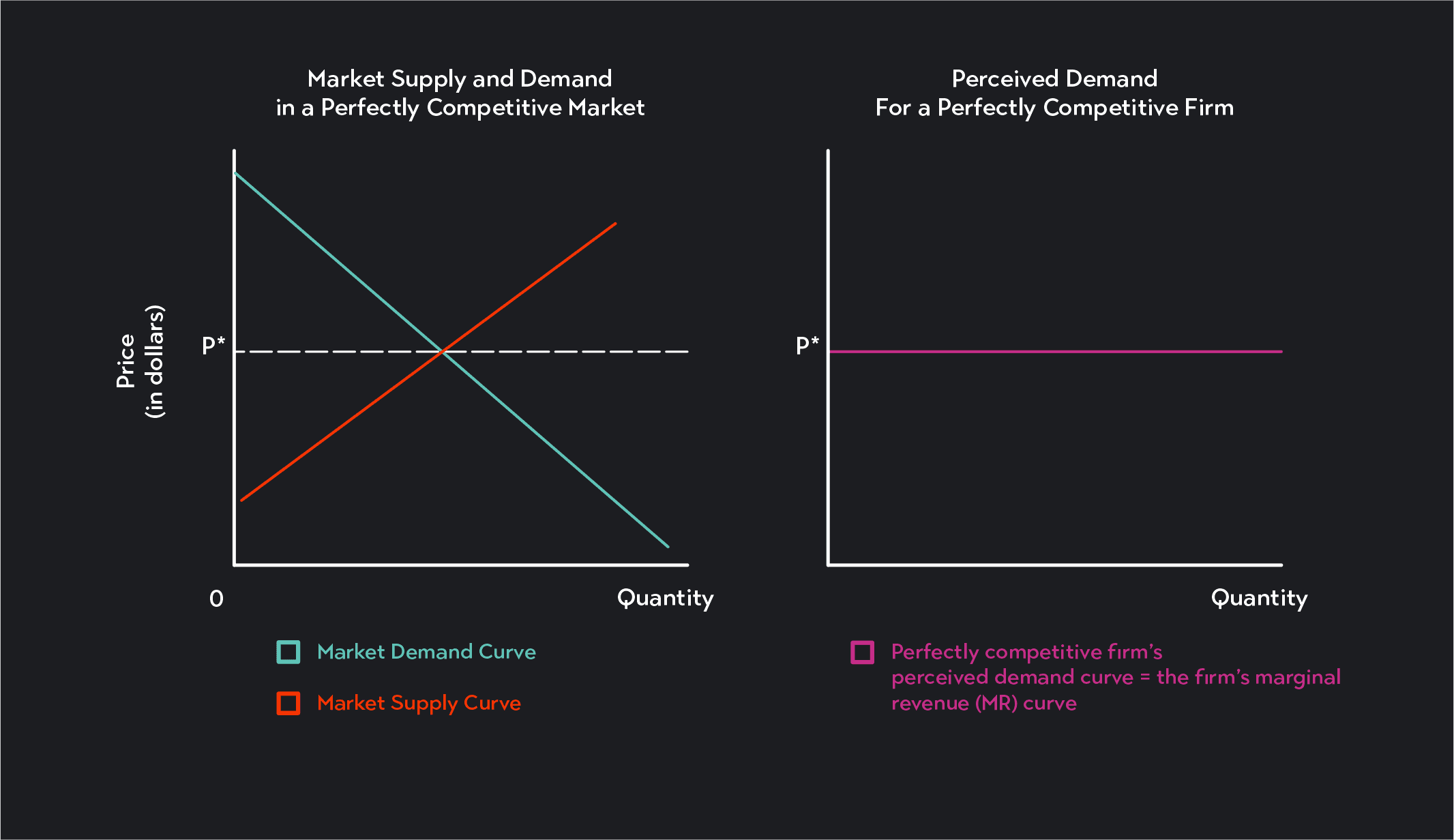

In the model of perfect competition, a downward-sloping market demand curve and an upward-sloping market supply curve represent demand and supply for the market as a whole.

For any individual firm operating in a perfectly competitive market, however, the demand curve is a horizontal line fixed at the market price, p*. We call this demand curve the firm’s “perceived demand curve,” because it represents how an individual firm experiences demand in the market.

The perceived demand curve is horizontal for any individual firm because the firm is a price taker operating in a market with many consumers. From the firm’s perspective, demand is perfectly inelastic. There are plenty of customers in the market. So as long as the firm charges the market price, there will be demand for any quantity of goods the firm wishes to sell. If the firm tries to sell at a price other than the market price, demand falls to zero.

For a perfectly competitive firm:

The Perceived Demand Curve = The Marginal Revenue Curve = The Average Revenue Curve

Recognize also that for a price-taking firm, the perceived demand curve is equal to the firm’s marginal revenue curve. Marginal revenue is the additional revenue a firm receives from selling one additional unit of its good or service, and because a price-taking firm always charges the market price, p*, when it sells its product, marginal revenue is always equal to the market price and marginal revenue is also equal to average revenue. MR = P* = AR.

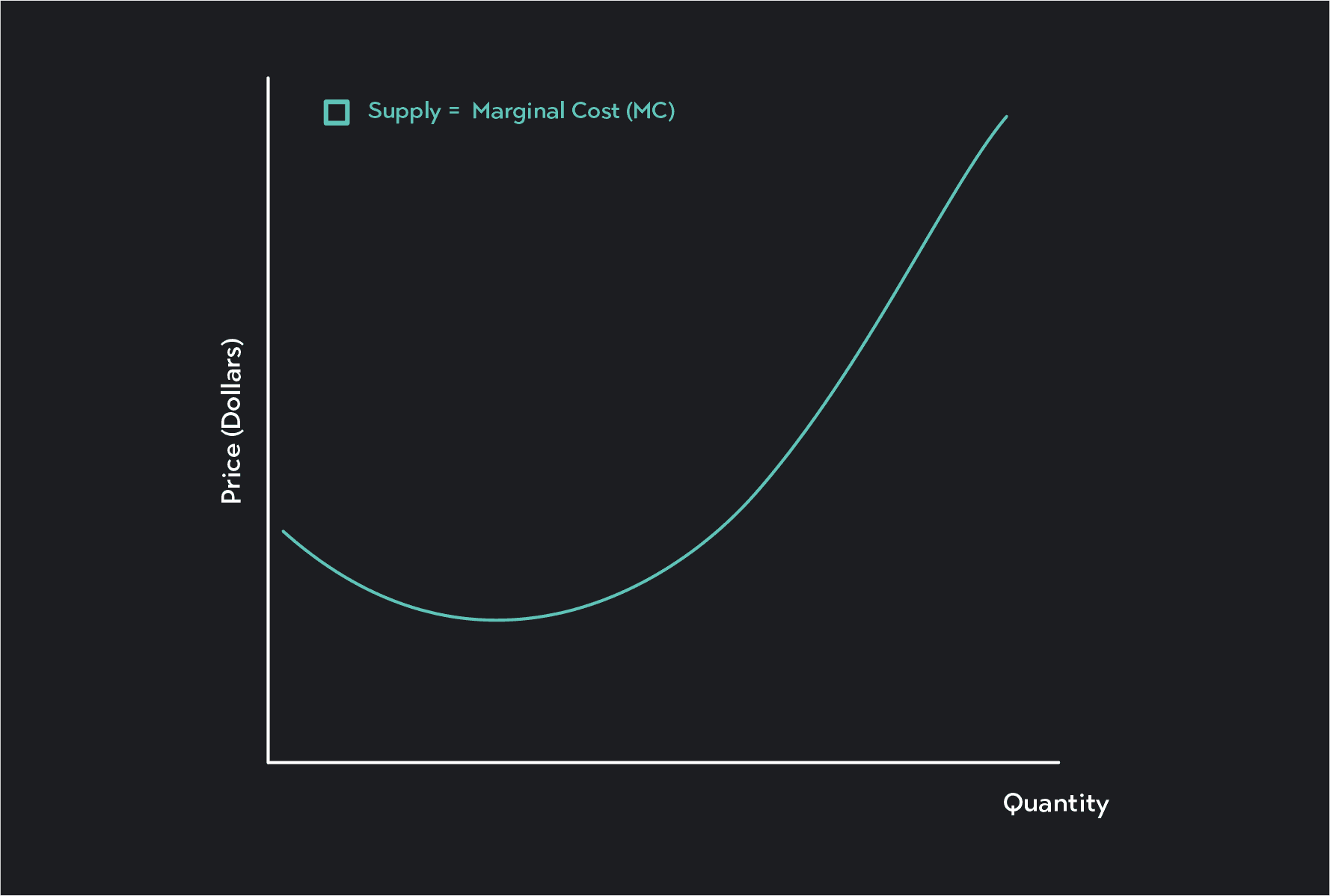

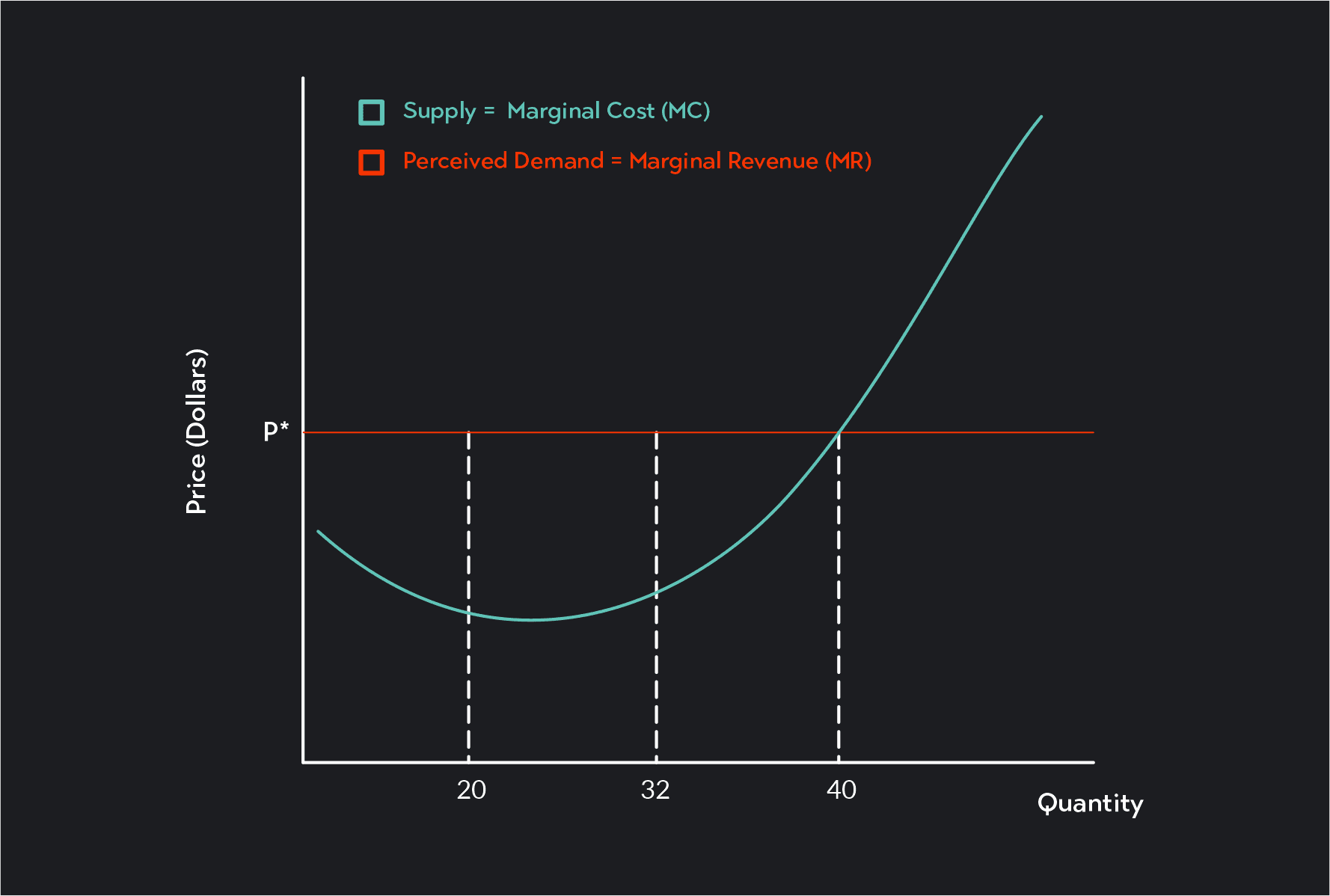

A firm’s supply curve shows the quantity of goods that the firm is willing to supply at different price levels. For a price-taking firm, the firm’s supply curve is equal to its marginal cost curve. The supply curve is typically u-shaped or upward sloping with the positive slope indicating that the firm is willing to sell more goods at higher prices.

For a perfectly competitive firm:

The Short-Run Supply = The Marginal Cost Curve

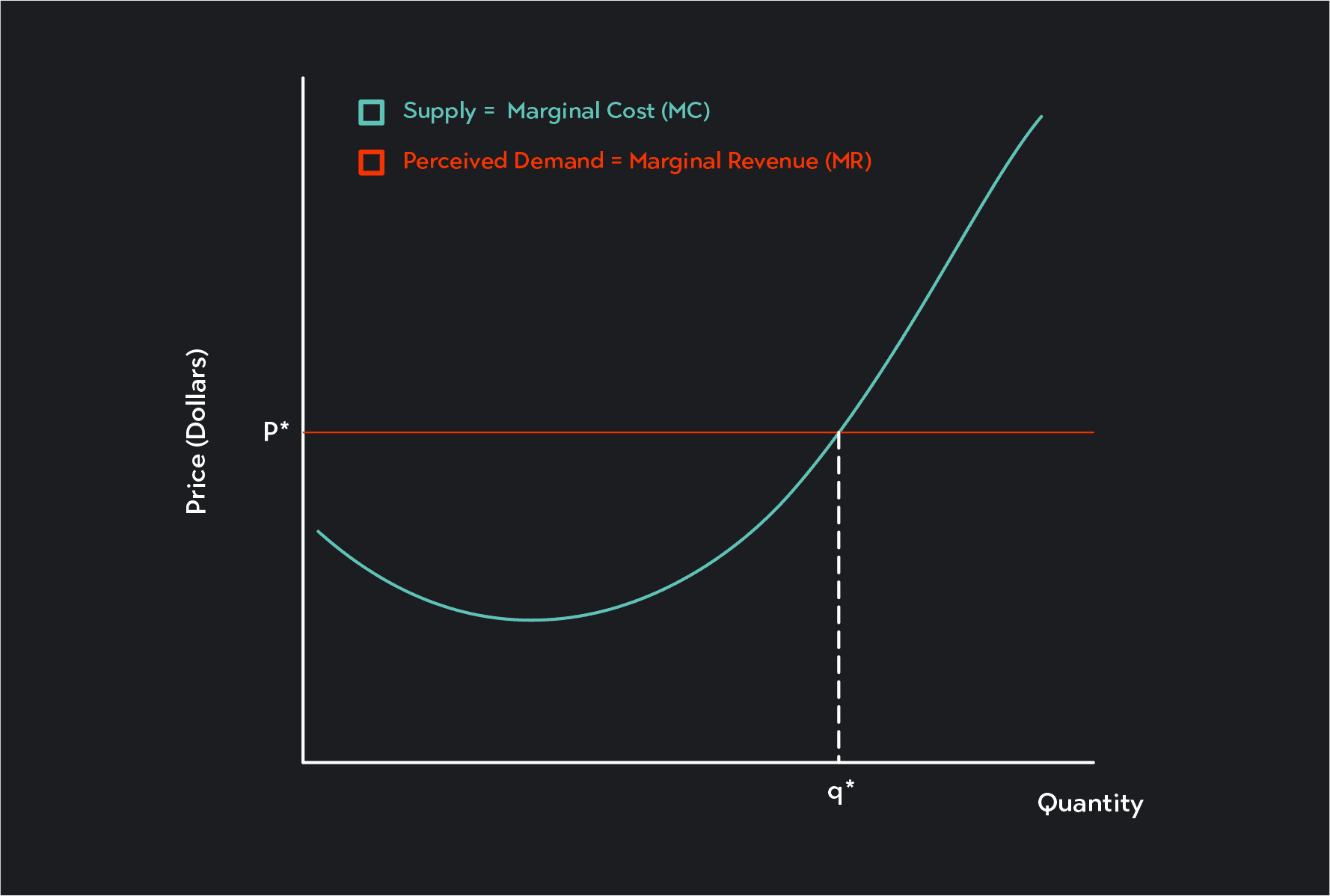

The profit-maximizing point of production for a perfectly competitive firm occurs where supply (marginal cost) is equal to the market price (marginal revenue). Up until this point, marginal revenue exceeds marginal cost, and the firm earns a marginal profit on each unit sold. Past this point, marginal cost exceeds marginal revenue, and the firm will lose money on every additional unit sold.

The Profit Maximizing Output for a Price-Taking Firm occurs where price equals marginal cost.

This is also where marginal revenue equals marginal cost:

A profit-maximizing point of production does not imply that a firm makes large economic profits. It does not even guarantee that a firm makes positive profits.

To understand whether a firm will incur short-run losses, break even, or make short-run profits, you need to compare marginal costs (MC) and average total costs (ATC) at the profit-maximizing point.

If MC > ATC at the profit-maximizing point, the firm will earn a positive profit

If MC = ATC at the profit-maximizing point, the firm breaks even

If MC < ATC at the profit-maximizing point, the firm will incur losses

In perfectly competitive markets, firms that continue to incur losses will exit the market, and firms that incur continued loses are forced to shut down. Alternatively, if firms in the market are able to earn positive profits in the short run, the potential profits will entice new firms to enter the market. In the long run, therefore, firms in a perfectly competitive market earn zero economic profits. They just break even.

Use the following examples and questions to test your understanding of perfectly competitive markets.

A perfectly competitive firm operates in a market where the price is $7. If the firm decides to charge $8 instead of $7, how many customers will it have?

The following table shows total costs and total revenue for a firm at varying quantities of output. Fill out the last column in the table and determine which quantity of output is profit-maximizing for the firm.

| QUANTITY | TOTAL REVENUE (TR) | TOTAL COSTS (TC) | TR-TC |

| 20 | $1,000 | $1,000 | |

| 21 | $1,050 | $1,025 | |

| 22 | $1,100 | $1,035 | |

| 23 | $1,150 | $1,130 | |

| 24 | $1,200 | $1,200 |

The following table shows costs and revenue for a firm at varying quantities of output. Which quantity of goods is profit-maximizing for this firm?

| QUANTITY | TOTAL REVENUE | MARGINAL REVENUE | TOTAL COSTS | MARGINAL COSTS |

| 75 | $7,500 | $100 | $3,000 | $45 |

| 76 | $7,600 | $100 | $3,070 | $70 |

| 77 | $7,700 | $100 | $3,150 | $80 |

| 78 | $7,800 | $100 | $3,250 | $100 |

| 79 | $7,900 | $100 | $3,400 | $150 |

The graph shows perceived demand and marginal costs for a perfectly competitive firm. What quantity of goods should this firm sell in order to maximize profits?

A perfectly competitive firm maximizes profits at a point where the price is $12, marginal cost is $12, and average total costs are $15. At this point, is the firm earning positive economic profits, breaking even, or incurring a short-term loss?

Zero. Remember, perfectly competitive firms are price takers and face a perfectly elastic demand curve. If the firm tries to raise prices above the market price, it will lose all of its customers.

The profit-maximizing quantity is 22. The last column, total revenue - total costs, is equal to profits. Profits are maximized where the difference between total revenue and total cost is greatest. This occurs at a quantity of 22. At this point, profits are equal to $65.

The profit-maximizing quantity is 78. There are two ways you could answer this question. You could calculate profits using the total revenue and total costs in the same way you answered question 2. A simpler approach is to look for the point where marginal cost is equal to marginal revenue.

The level of output that will maximize profits is 40. This is the quantity that corresponds to the intersection of the perceived demand curve and the firm’s supply curve. It is the point where marginal cost is equal to marginal revenue (the market price).

The firm is incurring a short-term loss. We know this because average total costs exceed marginal costs at the profit-maximizing point.

Outlier (from the co-founder of MasterClass) has brought together some of the world's best instructors, game designers, and filmmakers to create the future of online college.

Check out these related courses:

Economics

Learn about what a supply curve is, how a supply curve works, examples, and a quick overview of the law of demand and supply.

Subject Matter Expert

Economics

This article gives a quick overview of perfect competition in microeconomics with examples.

Subject Matter Expert

Economics

This article is a comprehensive guide on the causes for a demand curve to change. Included are five common demand shifter examples.

Subject Matter Expert