In This Article

What Is Perfect Competition?

Understanding How Perfect Competition Works

The Good and the Bad of Perfect Competition

What Does the Demand Curve Look Like in Perfect Competition?

A Real-World Example of Perfect Competition

What Is Perfect Competition?

Perfect competition is an economic model of market structure. Economists use it to study behavior and outcomes in highly competitive markets — highly competitive, meaning no buyer or seller has power over other buyers and sellers. In perfect competition, all market participants interact on a level playing field.

Main Assumptions of the Perfect Competition Model

In the model of perfect competition, markets have the following characteristics:

Many buyers and sellers are present.

An identical product or service is bought and sold.

Low barriers to entry and exit are present.

All participants in the market have perfect information about the product or service being sold.

These characteristics are the fundamental assumptions on which the model of perfect competition rests. Some of these assumptions are extreme, and no real-world market exhibits all of them. The model of perfect competition, like all economic models, is a simplified version of what we see in real life.

Understanding How Perfect Competition Works

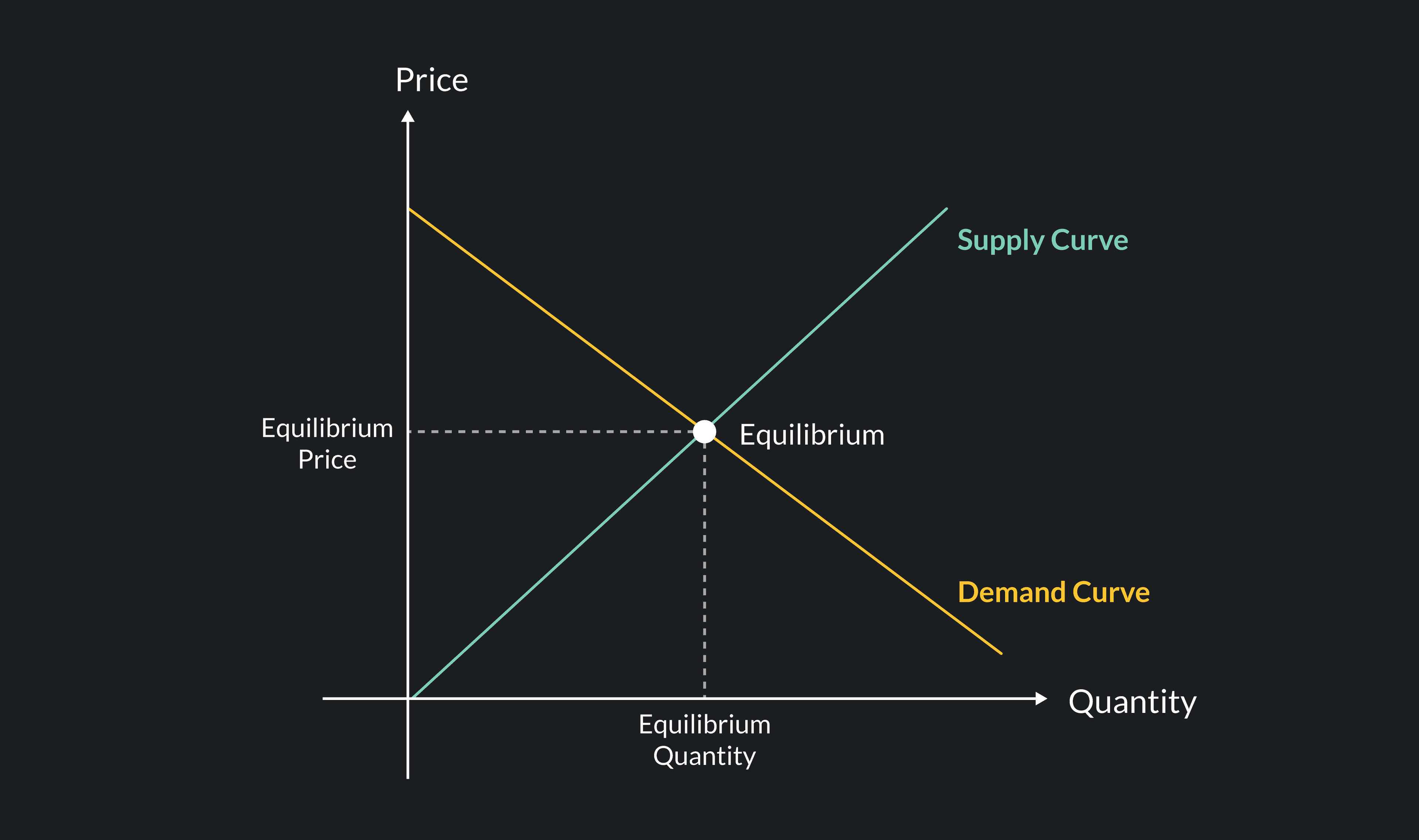

On a graph, a standard supply and demand diagram shows perfect competition with a downward sloping demand curve and an upward-sloping supply curve.

The four main takeaways of the model are the following:

1. In perfect competition, equilibrium occurs at the intersection of supply and demand.

Equilibrium, in economics, refers to the outcome that quantities in the model gravitate towards. In perfect competition, equilibrium occurs at the point where supply equals demand. This is the point where the supply and demand curves intersect on the graph.

If you trace the equilibrium point down to the horizontal axis, you’ll find the equilibrium quantity. If you trace the equilibrium left to the vertical axis, you’ll find the equilibrium price. These are the price and the quantity of goods expected to be bought and sold in the market. We also call these values the market-clearing price and quantity.

2. A perfectly competitive market brings itself into equilibrium without any outside intervention.

If a market is perfectly competitive, it will gravitate towards the market equilibrium without any intervention from the government or other outside forces. Suppose that the market price is above the equilibrium. In that case, excess supply will put downward pressure on price, which causes supply to fall and demand to increase until they are in equilibrium. If the market price is below the equilibrium, excess demand will put upward pressure on the price, which will result in supply increasing and demand decreasing until they are in equilibrium.

3. Equilibrium in the perfect competition model is Pareto efficient.

The equilibrium in perfect competition is a desirable outcome because it leads to a Pareto efficient allocation of the product being sold. Pareto efficiency means that no one can be made better off without making somebody else worse off.

Pareto efficiency is an important implication of perfect competition. It implies that any market manipulation, such as imposing price ceilings, price floors, quotas, or taxes, can only improve the well-being of certain market participants at the expense of others.

4. All firms are price takers and will make zero profits in the long run.

A perfectly competitive firm is a price taker, meaning they must take the equilibrium price as given. Due to the level of competition, sellers (or firms) in perfect competition do not have the power to set prices. If a seller tries to increase their price above the market-clearing price, competitors will undercut them, and buyers will shop elsewhere. The seller has no incentive to charge a lower price than the market price since they can do better by charging it. As an extension of this fact, perfect competition implies that no seller in the market will turn a profit in the long run. Sellers can only break even.

Other Models of Market Structure

Perfect competition is not the only way to model markets. It is one of many market structure models.

Here are some examples of other market models that economists use:

Monopoly - A model of a market with a single seller.

Monopolistic competition - A model of a market with many sellers who are selling similar goods that are not perfect substitutes (i.e., not identical).

Monopsony - A model of a market with a single buyer.

Imperfect competition - Models of how competing firms and buyers act when one or more of the perfect competition assumptions are violated.

Oligopoly - A model of a market with a handful of sellers.

Duopoly - A model of a market with two predominant sellers.

Duopsony - A model of a market with two buyers.

Cartels - An oligopoly model where sellers coordinate on important aspects of the market such as output, price, and market share.

As you can see, there are plenty of models to choose from.

The Good and the Bad of Perfect Competition

We can summarize the advantages and disadvantages of the model of perfect competition as follows.

Main Advantages

1. Perfect competition works well as a simple version of how competitive markets work.

While there are no real-world markets that exhibit all of the assumed characteristics of perfect competition, the model provides a good representation of what goes on in some highly competitive markets that sell homogenous (very similar) goods. These include markets for agricultural products like bananas or wheat, foreign exchange markets, and certain types of online markets where the barriers to entry are low and where buyers can easily surf the web to compare prices.

2. Perfect competition also works well as a benchmark model.

With this model, economists can compare and contrast outcomes in markets that are less competitive or not competitive at all.

Main Disadvantages

1. No incentives for seller innovation.

The model of perfect competition leaves out many aspects of real-world economic competition that economists believe are crucial to understanding market behavior. These include sellers’ incentives and ability to innovate and differentiate their product from other products in the market, barriers to entry that exist even in highly competitive markets, and imperfect information (often sellers and buyers lack important information about the market and the product they are buying or selling).

2. Not as insightful.

A second disadvantage of the model has less to do with the model itself and more to do with how you apply it. The model of perfect competition is often used carelessly or dogmatically to describe markets that are not at all close to the model.

The real world is full of markets that violate the assumptions of perfect competition.

It is filled with:

Markets without many buyers and sellers.

Markets that have high barriers to entry and exit.

Markets where differentiated goods are bought and sold by unsuspecting buyers and sellers.

One of the drawbacks of the perfect competition model comes from assuming that it explains all or even a majority of market outcomes. While it can be useful to compare any market to perfect competition, other economic models will often provide better insights into how imperfectly competitive markets operate.

What Does the Demand Curve Look Like in Perfect Competition?

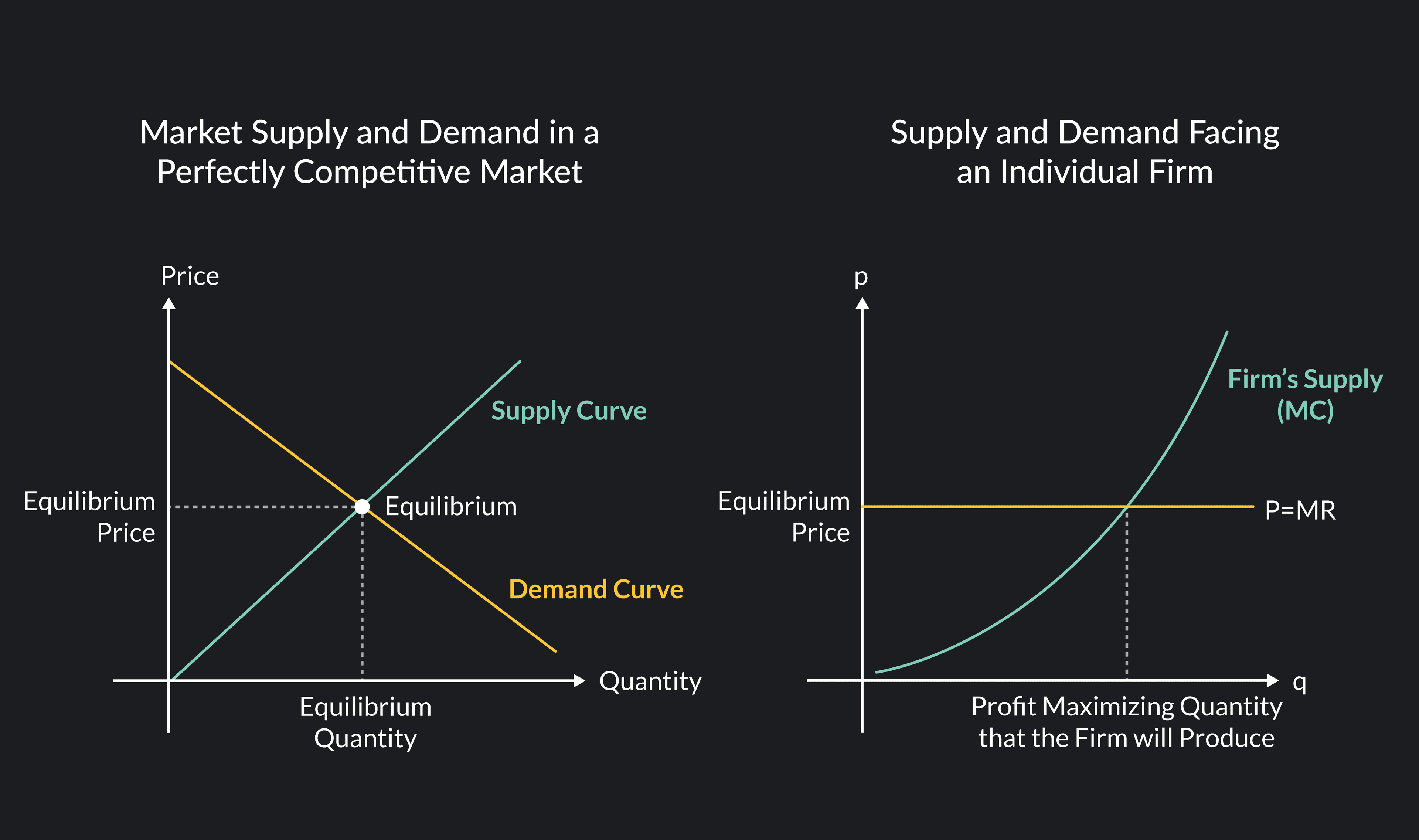

Many factors can make a demand curve shift but this is a different situation. As we saw above, the market demand curve in perfect competition is downward sloping. From the perspective of a single firm or seller, however, the demand curve is fixed at the equilibrium price and is represented by a horizontal line at the market-clearing price.

Remember, in perfect competition, sellers take the market price as given and decide whether and how much to produce based on that price. The seller’s decision of how much to produce is based on production costs and revenue. Because the price is fixed at the equilibrium price, a seller’s marginal revenue is just equal to the price (p=MR). The firm’s marginal costs are represented by its supply curve (supply = MC).

It is in the seller’s best interest then to sell the number of goods where the market price is just equal to the marginal cost of producing the very last unit produced. This is equal to the point where the firm’s supply curve intersects the horizontal demand curve.

The graphs below show the market supply and demand on the left and the supply and demand of an individual seller on the right.

A Real-World Example of Perfect Competition

Perfect Competition and Gala Apples

Imagine you’re walking down the street, and you come across a fruit stand selling fresh fruit. A crate full of Gala apples has a sign that reads $1 per apple. If you shop for apples regularly, you know that these apples are overpriced. A non-organic Gala typically sells for about 58 cents per apple or about $2.30 per lb. Unless the worker at the fruit stand gives you a good explanation for why the apples are so expensive, you likely won’t buy any apples from them. You know that if you want to buy apples, you can go to another store and find reasonably priced apples there.

The market for Gala apples is an example of a real-world market that perfect competition models well. Many people consume Gala apples, many businesses sell Gala apples, and there isn’t much variation from one Gala to the next. The market tends to settle at a point where supply equals demand, and most sellers who try to charge above the market price will have a hard time staying in business.

The characteristics of the Gala apple market are not identical to perfect competition, but they are reasonably close, which means the model provides a good approximation of what goes on in the market.

Seller Innovation

Despite many similarities between the model of perfect competition and the market for Gala apples, it is also interesting to consider how the real world departs from the model. In real life, sellers of any product do not like competition; it hinders their business. This is why sellers (even those facing harsh competition) have an incentive to try to innovate and differentiate their products from their competitors. If they can convince buyers that their product is different enough from the rest, it suddenly provides sellers with some price-setting power, which is good for business.

There are different ways that sellers try to differentiate their products from their competition. Strategic marketing campaigns can convince buyers that a product is unique and better than the rest. A strategic location of a business might also give a seller an edge over their competition. Finally, sellers can try to innovate and improve their product so that it truly does become something that sets itself apart.

Think back to our fruit stand. If the seller at the fruit stand is a miraculous saleswoman, she may be able to convince you that her apples are special and worth the extra 50 cents. If the fruit stand is located far from any other grocery store or farmer’s market, you may be willing to pay the higher price rather than hike to another store.

Finally, the best apple orchard in the country might operate the fruit stand, in which case, you might feel obligated to spend $1 and try the best Gala apples around. These are all ways that the real world can deviate from the model.

Perfect competition helps explain why you will tend to see Gala apples priced close to 58 cents or $2.30 per pound in most fruit stands and grocery stores. However, there are also reasons why you may see a rare seller keeping her business running even while charging $1 per apple.

Some products are easier to differentiate than others. If you have sole access to the inputs needed to produce a good or if you have a patent on a new drug, it’s easy to differentiate your product and be one of a few or even the only seller in the market. Other products are harder to differentiate, but back to our apples.

Some Very Expensive Fruit

It seems far more difficult to convince buyers of a large difference in the quality of two pieces of fruit, but some sellers actually manage to do this.

As an example, in Japan, a market has emerged for luxury fruit that exists apart from the market for everyday apples and oranges. These high-end fruits are often bought as gifts, and prices far exceed what you would expect to see in a typical grocery store aisle. In 2019, two Yubari “King” Melons sold for 5 million yen, which is about $44,000! Clearly, the melon growers of Yubari (a small city in Hokkaido) have found a way to break away from their competition.

Even in the United States, we now see emerging online businesses claiming to deliver fresh off the tree, one-of-a-kind fruit to your door at prices which, at some point, might have seemed outrageous.

To conclude, the model of perfect competition is one of many models that economists use to study markets. Modeling perfectly competitive markets gives us important insights into how sellers and buyers behave in the face of competition. The model of perfect competition is a simple and foundational tool that can help you understand a lot about the economy, but it is not the only tool you should use to understand how markets work.

Explore Outlier's Award-Winning For-Credit Courses

Outlier (from the co-founder of MasterClass) has brought together some of the world's best instructors, game designers, and filmmakers to create the future of online college.

Check out these related courses: