What Is a Price Floor?

How a Price Floor Works

Binding and Non-Binding Price Floors

What Can Happen as a Result of a Price Floor?

Real-World Examples of Price Floors

Another Form of Price Control: Price Ceilings

What is a Price Floor?

A price floor is a regulation that prevents buying and selling a good or service below a specified price.

Price floors are often implemented with one or more of the following goals in mind:

To push the price of a good or service above the market price.

To reduce the demand for goods or services thought to be harmful.

To encourage the production of goods or services in a government-assisted industry.

To promote the welfare of low-wage workers (this is the case for minimum wage laws, which are price floors set on the wages employers can pay their workers).

How a Price Floor Works

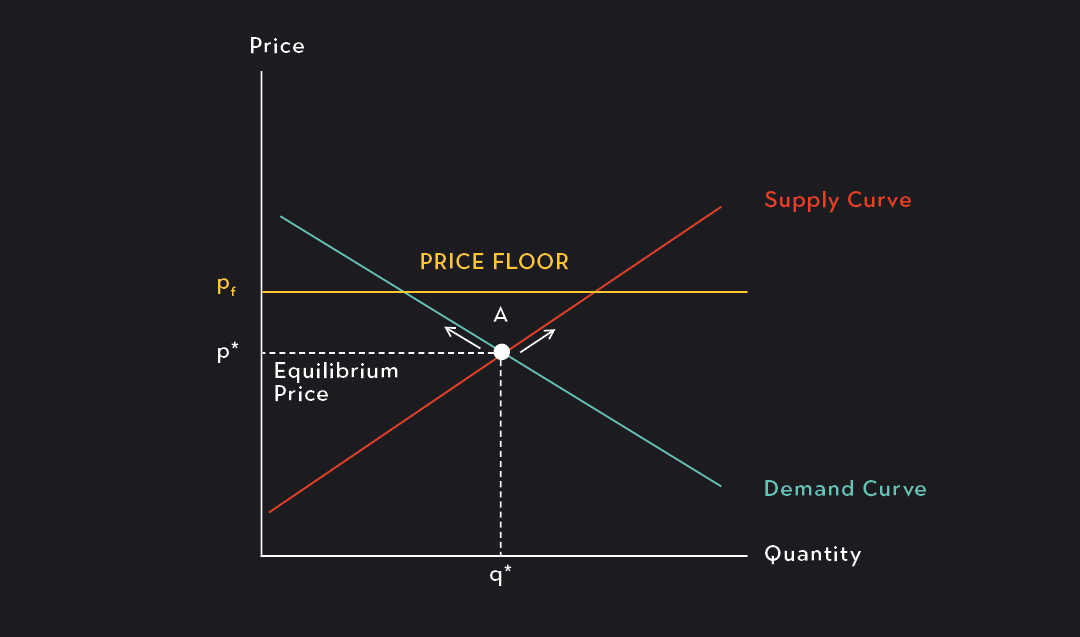

In a competitive market, the price of a good or service is determined by the intersection of supply and demand. This is called the market price, p*.

When a price floor is in place, market participants are prevented from buying or selling below a given price, pf. If the price floor is set above the market price (pf>p*), buyers and sellers will adjust their behavior in response to the higher price. Buyers will demand fewer units of the good and as a result, fewer units of the good will be sold. Meanwhile, suppliers will want to produce greater quantities of the good. This can lead to overproduction or a surplus of goods in the market.

Binding and Non-Binding Price Floors

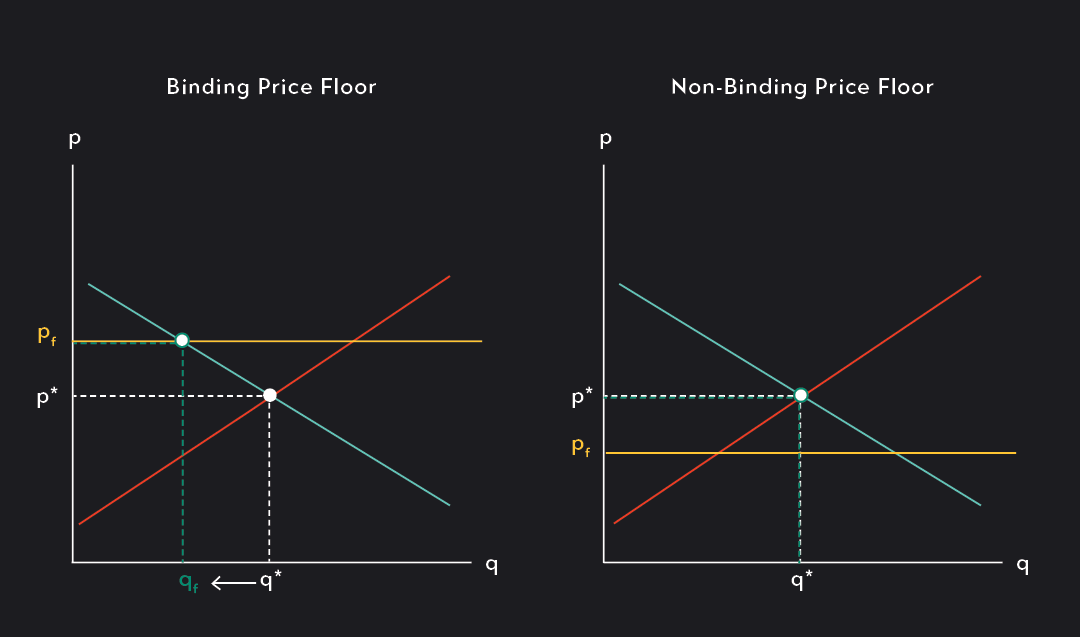

A price floor that is set above the equilibrium price is called a binding price floor. For a price floor to have an effect, it must be binding. A binding price floor makes it illegal to buy and sell at the equilibrium price or any other price that falls below the price floor.

A price floor that is set below the equilibrium price is called a non-binding price floor. A non-binding price floor has no effect in a competitive market, because the equilibrium price already exceeds the price floor. In the non-binding case, market participants will continue to buy and sell at the equilibrium price and quantity.

What can happen as a result of a price floor?

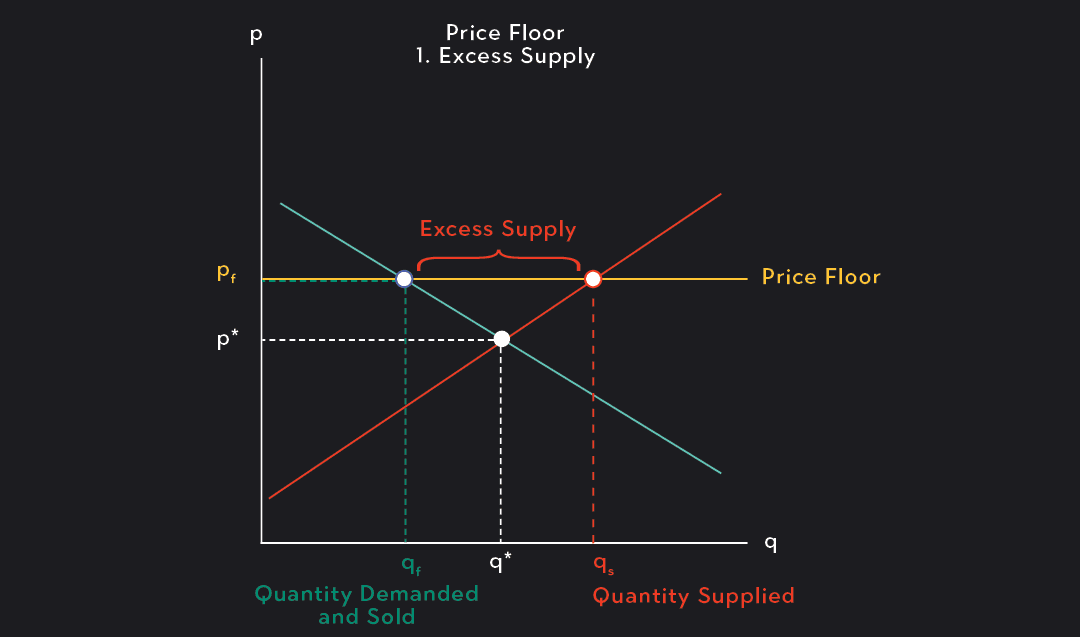

Excess supply. As we have already seen, a binding price floor raises the price of a good above the equilibrium price. This leads to a reduction in demand and an increase in supply. Quantity supplied will exceed the quantity demanded, which leads to a surplus of goods in the market.

Deadweight loss. A binding price floor also results in a deadweight loss caused by a reduction in goods sold. A subset of buyers who would have made purchases in the competitive market will no longer benefit from doing so. Likewise, some sellers who would have made additional sales in a competitive market lose that benefit.

An overall reduction in consumer surplus. When a price floor is implemented, consumers are harmed more than suppliers. Consumers who remain in the market are charged a higher price, while consumers who exit the market lose the entire benefit of purchasing the good. In other words, total consumer surplus falls because of deadweight loss and because a portion of the consumer surplus is reallocated to the producers.

Changes in producer surplus. Price floors have a mixed effect on producers. The reduction in the number of goods sold is a loss for some producers. This is reflected in the deadweight loss. On the other hand, the higher price charged for the goods that are sold is a benefit. This benefit is reflected in the portion of surplus that is reallocated from the consumers to the producers.

The emergence of black markets. Price floors can sometimes lead to black markets. Black markets are unauthorized or illegal means of buying and selling goods. Sellers and buyers who wish to circumvent the price floor may try to buy and sell in this manner.

Real-World Examples of Price Floors

A Price Floor on Tobacco

In 2018, New York City increased its price floor on cigarettes from $10.50 per pack to $13 per pack. A few other counties and cities in the United States also have price floors on the sale of cigarettes and other tobacco products. Price floors on products such as tobacco and alcohol are aimed at reducing demand for products considered harmful to consumers.

Price Floors on Agricultural Products

As economies started to industrialize and urbanize in the 20th century, many governments started implementing price floors to support rural populations and their shrinking but vital agricultural industries. Price floors on agricultural products are designed to keep production levels and prices high. This incentivizes producers to continue farming when the free market might otherwise incentivize them to turn to other occupations. It also protects farmers against unpredictable fluctuations in their yield.

Because price floors create a surplus of goods, when governments implement agricultural price floors, they typically intervene in the market by offering to buy the surplus directly from producers.

A Price Floor on Wages (Minimum Wage Laws)

Minimum wage laws are a special type of price floor. You can think of a minimum wage as a price floor set on the price of labor. In this case, employers are on the demand side of the market and employees are on the supply side of the market. The price floor regulates the minimum wage that can be paid by employers to workers.

The outcomes of implementing (or raising) minimum wages are a matter of considerable debate. If you believe that the market for low-wage labor is competitive, then a price floor on wages would create unemployment due to a reduction in the demand for labor and an increase in the supply. Low-wage workers who remain employed under a minimum wage would benefit from a higher wage, but many other workers might lose their jobs and struggle to find work.

For a long time, economists cautioned against minimum wage hikes believing that the resulting loss of jobs would be far worse than any benefits to workers who remained employed. More recently, however, the position of economists has changed. Today, many economists believe that the market for low-wage labor is not competitive and that employers exercise a fair amount of market power when they set wages. If this is the case, the effects of a minimum wage hike are far more ambiguous. A small increase in the minimum wage could, in fact, increase employment. A large increase could still result in a loss of jobs.

Another Form of Price Control: Price Ceilings

Price floors are just one form of price control. The opposite of a price floor is a price ceiling. Price floors and price ceilings are both intended to move prices away from the market equilibrium, but they are designed to do so in opposite directions.

While a price floor imposes a minimum price on the purchase and sale of a good, a price ceiling does the exact opposite. It imposes a maximum price. For a price ceiling to be binding, it must be below the equilibrium price rather than above it. Price ceilings are typically implemented to keep prices low for the benefit of consumers. These regulations increase demand and reduce supply resulting in a shortage of goods, and they tend to benefit the demand side of the market more than the supply side.

It’s easy to confuse price floors and price ceilings, so be sure to double-check your understanding of these price controls when you encounter them.

Explore Outlier's Award-Winning For-Credit Courses

Outlier (from the co-founder of MasterClass) has brought together some of the world's best instructors, game designers, and filmmakers to create the future of online college.

Check out these related courses: