Economics

Understanding the Supply Curve & How It Works

Learn about what a supply curve is, how a supply curve works, examples, and a quick overview of the law of demand and supply.

Alejandro Diaz Herrera

Subject Matter Expert

Economics

03.08.2022 • 7 min read

Subject Matter Expert

Here’s an overview about what tax incidence is, how it works, and how it relates to price elasticity.

In This Article

For every economic transaction, the government imposes a tax. But who should pay that tax? Does the tax burden fall onto the buyer or the seller? Or maybe both? This article will discuss tax incidence, the economic analysis that determines how the overall cost of taxes is distributed between buyers and sellers.

Tax incidence is how the tax burden is divided between buyers and sellers. This division of the tax expense is primarily determined by the relative elasticity of the supply and demand for the goods or services we are discussing.

Usually, the tax incidence falls on both the consumers and producers. However, to calculate which side will pay the majority of the tax, we analyze the demand and supply elasticity. The tax cost will be more significant for the more inelastic side of demand and supply. If the demand for a good is more inelastic than the supply, the buyers will then burden more of the tax cost. Inversely, if the supply side is more inelastic than the demand, the producers or sellers will pay most of the tax.

Tax incidence is how the tax burden is divided between buyers and sellers.

Let us quickly review how elasticity works, and then we will see how it determines which party in a transaction will pay the tax. Elasticity is the percentage change of the quantity demanded or quantity supplied relative to its price change.

Simply put, the more sensitive buyers are to a price change of any good or service, the more elastic the demand will be. The demand side is inelastic when the percentage change in the quantity demanded is not significantly affected by a change in price. Meaning a big move in the price will not cause a big difference in the quantity demanded. The same would be on the supply side of the market.

Elasticity is determined by how sensitive the willingness or ability of producers is to supply the goods or services. The more susceptible they are to different factors, the more elastic the supply will be. Supply is considered inelastic when the percentage change in the quantity being supplied is less than the percent change in price. With this in mind, we can now see that the burden of taxation is passed to the more inelastic side of the market because that is the side that is less sensitive to a price change.

To see how tax incidence is determined by the relative elasticity of demand and supply, let's use the example of medicine or healthcare. Consumers of medical treatment or drugs are not too sensitive to a price change, so it's inelastic. Even if the price of a particular drug rises sharply, the people dependent on it will still have to buy it.

So the quantity of demand for that drug will not change even with a significant price change. Therefore, if the government imposes a tax on that drug, producers of the drug will pass the tax cost onto buyers because the demand for it is inelastic. Even if the price of the medicine rises, it will not significantly affect the quantity of demand.

Another example where most of the tax expense falls on the buyer is cigarettes. Although there is a pretty high tax on cigarettes, the buyers—not the sellers—pay most of it. Since many smokers are somewhat addicted, they are not that sensitive to a price change. If sellers increase the price of cigarettes to capture the entire tax cost, it will not significantly change the quantity demanded. So the tax incidence here again shows us that the cost is distributed to the more inelastic side of the market.

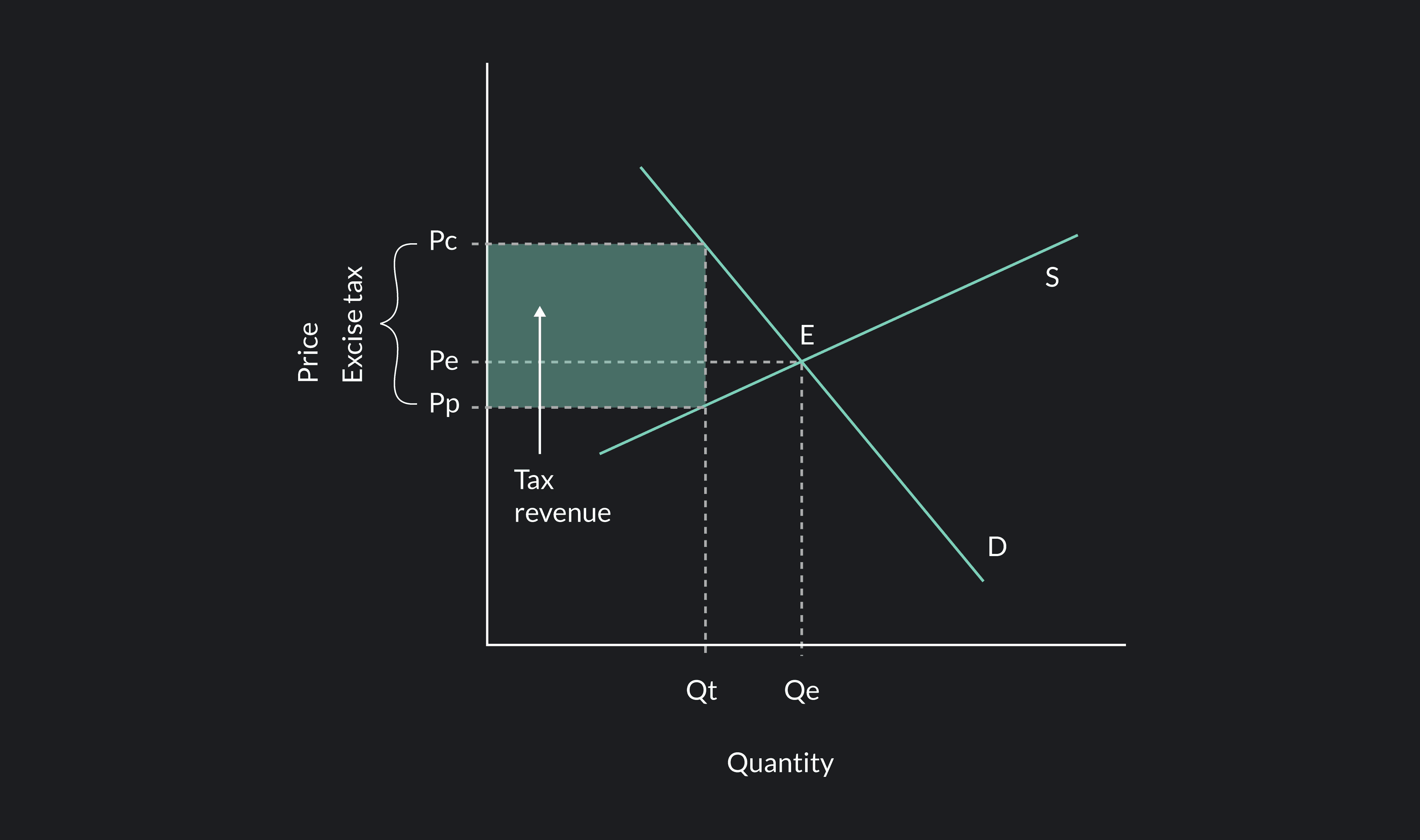

is the equilibrium price before taxes are introduced. The distance between the price paid by consumers and the price producers receive is the tax revenue per unit sold. In this diagram, the supply is more elastic than demand, so the tax incidence falls more on consumers than on producers as we see is larger than .

Now let's look at an example where the supply is inelastic. Where producers are willing to supply relatively the same amount no matter the price, they can sell it. On the other hand, the demand is elastic; consumers are sensitive to the price, so a slight price increase will cause a significant decrease in the demand.

An example of this is luxury goods like jewelry, art, or expensive cars or furniture. Since these things are not a necessary good—as opposed to medicine or healthcare—buyers are sensitive to any price changes. A slight increase in price causes a more significant percentage decrease in demand.

Thus, if a tax is imposed on such a good, the producers will have to bear most of the cost. Since the consumption of luxury goods is elastic, the producers or sellers cannot pass the cost of taxes onto the consumers without affecting the quantity of demand. So the tax incidence in such a case falls more on the sellers than on the buyers.

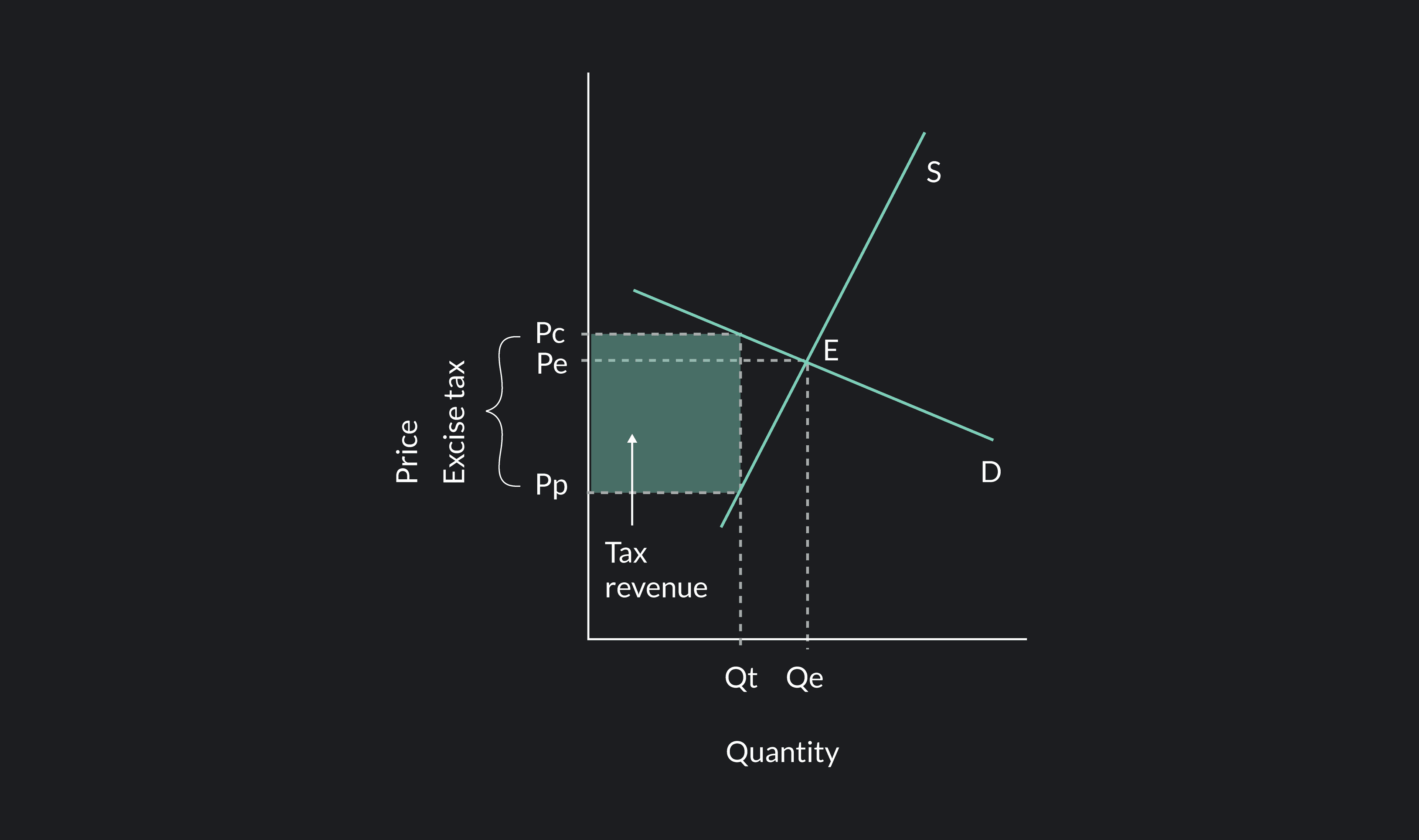

is the equilibrium price before taxes are introduced. The distance between the price paid by consumers and the price producers receive is the tax revenue per unit sold.

In this diagram, the demand is more elastic than supply, so the tax incidence falls more on producers than on consumers as we see is larger than .

With most goods and services, demand and supply are not entirely inelastic or elastic; the entire tax burden does not fall on only one side of the market. Typically, this means that the producer or seller can pass at least some of the tax expense onto the buyer as higher prices. Whatever portion of the tax is not captured in the sale price, falls onto the cost of producers or sellers.

To see how the cost of tax gets divided between buyers and sellers, let's imagine the government imposes a new tax on soda. Let's assume the new tax will be $0.25 on every bottle of soda sold. The first step for us to see who will end up paying the new 25 cent expense is to calculate the price elasticity of demand and supply.

So let's assume that for a 10 percent increase in the price of soda, the rate of demand drops about 7%.

So our demand elasticity is:

Let us assume the supply of soda is somewhat inelastic. For every 2% change in the price, there is a 1% change in the quantity demanded.

So we get:

Now that we have the relative elasticity of both the demand and supply, we can go ahead and calculate the tax incidence for soda:

100% – 41% = 59% is the amount of tax incidence paid by the seller.

What we see here is that the party with the greater elasticity—the producers of soda—ends up paying a bigger portion of the tax.

Outlier (from the co-founder of MasterClass) has brought together some of the world's best instructors, game designers, and filmmakers to create the future of online college.

Check out these related courses:

Economics

Learn about what a supply curve is, how a supply curve works, examples, and a quick overview of the law of demand and supply.

Subject Matter Expert

Economics

This article gives a quick overview of perfect competition in microeconomics with examples.

Subject Matter Expert

Economics

This article is a comprehensive guide on the causes for a demand curve to change. Included are five common demand shifter examples.

Subject Matter Expert