College Success

45 Easy Ways To Save Money In College

Here’s an overview on saving money in college, why it is important, and 45 easy ways to do it.

Nick Griffin

Subject Matter Expert

College Success

02.10.2023 • 7 min read

Subject Matter Expert

Learn the best ways to save for college. We’ll explain the importance of saving money, when to start, the best plans, and extra money-saving tips.

In This Article

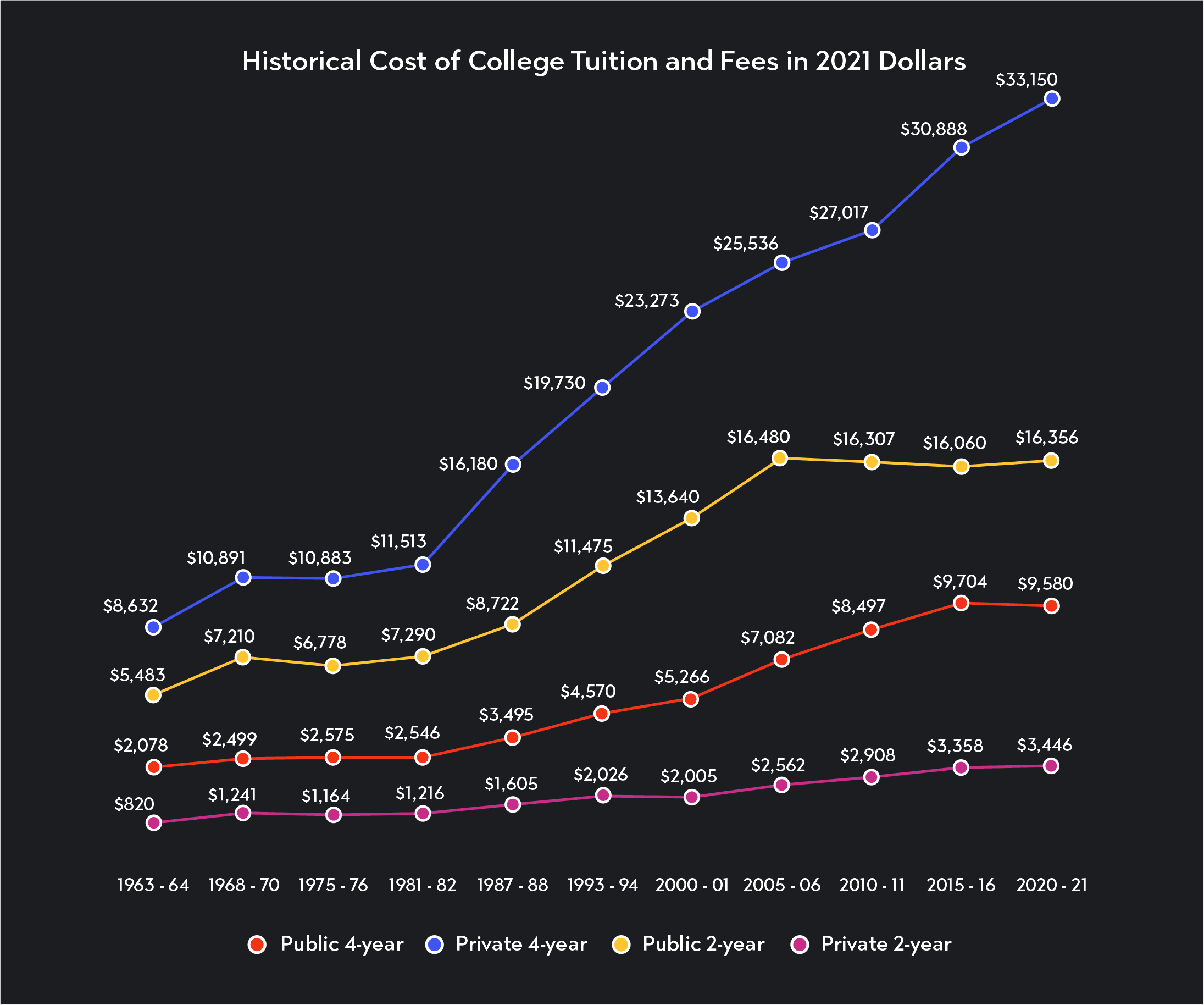

Back in 1963, a student paid today’s equivalent of $2,078 in tuition at a public, 4-year college. In 2020, that same tuition cost $9,580. That’s a 361% increase.

Since 1970, college costs have increased faster than incomes. It’s safe to say that saving for college is not what it used to be.

Source: https://educationdata.org/

This graph’s uphill mountain—and today’s tuition rates—look intimidating. But it doesn’t have to be.

College can be affordable, especially with a plan.

In this article, we’ll go over why it’s important to save for college, when to start, and the different saving plans.

And after saving thousands of dollars earning my bachelor's degree, I have some practical saving tips from my own journey that’ll go a long way.

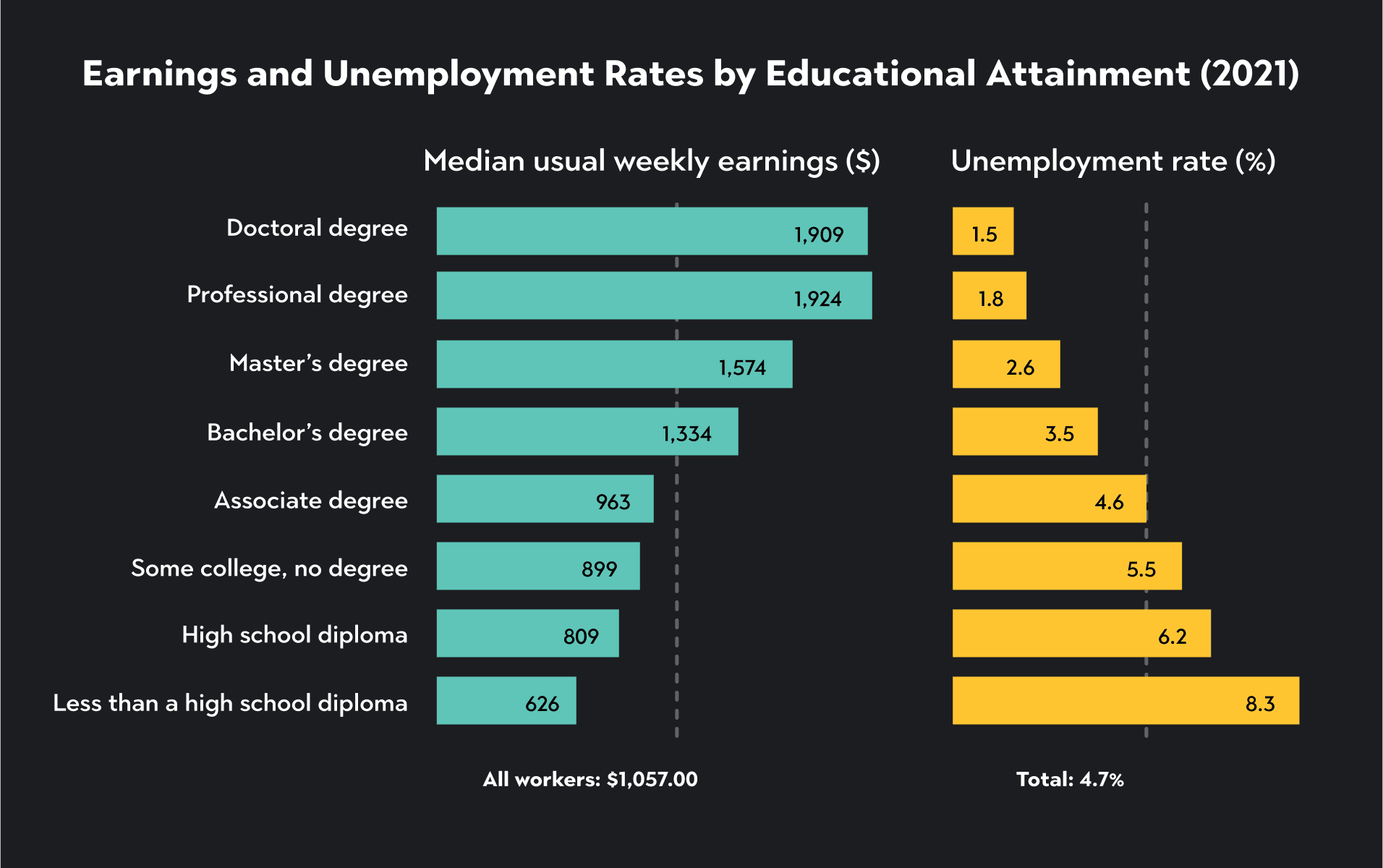

When it comes to saving, earning a college degree is worth the investment. This especially holds true when it comes to salary and employment. The Bureau of Labor Statistics found that those with college degrees have lower unemployment rates and higher median earnings overall.

Source: https://www.bls.gov/emp/chart-unemployment-earnings-education.htm

Saving is also a great way to avoid paying big costs upfront. A 2021 report from the College Board found that the estimated budgets for undergraduates ranged from about $18,000 at two-year public colleges to about $55,000 at four-year private colleges. These averages included tuition and fees, room and board, and other college expenses for the school year.

Although these numbers may seem scary, saving for college can help you attack these educational costs smartly and purposefully. Keeping to college savings plans or student budgets can take time and effort. Still, there are ways to save up and keep costs down before and during college.

The short answer is: the sooner, the better! Time is your greatest asset. While the answer to this question can vary based on age and socioeconomic status, experts agree it’s important to start saving as soon as possible. Given the rising cost of college, higher education must be paid for over time.

Saving early can be a lifesaver. Every dollar you can contribute from savings is one dollar less you need to borrow from essential household expenses.

Let’s say you saved $5 a day for different periods of time. As you can see in the table below, the longer you save, the bigger the end amount will be.

| Length of Time Saving $5/day | Total Savings |

| 1 month | $150 |

| 1 year | $1,825 |

| 10 years | $30,000* |

| 30 years | $330,000* |

| 50 years | $2.3 million* |

*in an account with a 10% annual return

With income from a part-time job, you can start your savings journey early. Let’s say you are in middle or high school, start by speaking to your parents or guardians about saving a certain amount of money to build your college fund. It’s also common for parents or guardians to start saving for college before their child is born—just ask.

Long story short, start saving immediately when you start earning your own money.

Let’s go through the many ways to save for college. Each has its pros and cons, especially in tax benefits. We’ll also answer if you can use the funds from each plan for non-educational purchases.

Here are the 5 best strategies to save money for college.

A 529 savings plan is often considered the best choice. Most financial experts recommend a 529 savings plan because of its appealing tax benefits and breaks.

Contributions to the state's 529 plan could benefit state income taxes.

Contributions and earnings grow tax-free.

There are no taxes on withdrawals for education expenses.

Investment options are limited.

Check plans thoroughly for good performance and fees.

You must use the money for the intended purposes or pay a penalty to get it back.

You could use the money to help pay off debt or make a down payment on a house or car. However, these withdrawals are nonqualified, so you will have to pay normal income taxes and a 10% tax penalty.

While they're not designed for college savings, Roth IRAs can help pay for a college education. A Roth IRA or Roth 401(k) has favorable tax treatment and allows a tax-free return of contributions. Similar to the 529 plan, contributions are made with after-tax dollars.

Contributions and earnings grow tax-free.

Contributions (not earnings) can be withdrawn free from income tax.

Money can remain in the Roth account to fund your retirement.

The annual contribution is relatively low compared to what you can contribute to a 529.

There's no state income tax deduction for Roth contributions.

Roth withdrawals count as financial aid and can affect aid eligibility.

Since Roth IRA accounts are funded with after-tax dollars, account owners can withdraw (up to a $10,000 lifetime maximum) before the standard retirement age of 59 without any taxes or penalties to pay for anything.

A UTMA/UGMA (Uniform Transfers To Minors Act/Uniform Gifts To Minors Act) plan is a custodial 529 college savings plan. However, it differs from a traditional 529 plan in some key aspects.

A custodial 529 technically belongs to the child. Still, the parent is considered the account owner, so the student could still highly benefit from financial aid.

Unlike college savings plans, there is no penalty if account assets are used to pay for anything other than college.

It can't be transferred to other family members.

You have to liquidate the account, resulting in a tax bill.

Funds can be used for anything—college, down payment, vacation—that benefits the child to which the UTMA/UGMA custodial account belongs to. It is also important to note that if the parent puts money in this account, they can never use it again. It solely belongs to the child.

A Coverdell Education Savings Account (ESA) is a trust account the government created to help families fund expenses for their child’s education. The account is established with the beneficiary under the age of 18.

Coverdell accounts are similar to 529 plans, but they can be used to pay for elementary and secondary school.

Withdrawals used to pay qualified education expenses are completely income tax-free.

The account can be transferred between family members.

Contributions aren't allowed after the beneficiary reaches age 18.

Coverdell funds must be used before a student is 30, or taxes and fees will accompany withdrawals.

These accounts have a contribution limit of only $2,000 each year.

You can only use Coverdell ESAs to pay for qualified education expenses (QEE), such as tuition, fees, books, and supplies. If you withdraw more than the amount of QEE, then the excess is subject to income tax and a 10% penalty.

Prepaid tuition plans allow you to pay for future college credits at today's tuition rates. States offer this in the form of a 529 plan that can cover the costs of in-state tuition.

Tuition is on the rise, and it might continue to skyrocket. A Prepaid Tuition Plan allows you to lock in today's college tuition rate.

Even though your state offers prepaid tuition plans, the funds can be transferred to private or out-of-state universities.

Most plans don't limit how much you can invest, allowing you to significantly contribute over time.

The state's prepaid tuition plan chooses how your funds are invested, so you do not get any investment options.

Only tuition and mandatory fees are typically covered by a prepaid plan. Plan to cover expenses such as books and room and board in some other way.

There may be pressure to explore only nearby schools instead of pursuing a more fitting one in another state.

You can only use prepaid tuition plans for tuition and mandatory fees. You cannot even use them for additional fees a college might charge. If you use the money for ineligible expenses, you will be subject to taxes and a 10% penalty.

All in all, it’s important to talk about your personal finances with a financial advisor or financial planner who can help determine the best path to covering qualified higher education expenses.

If you’re stressed about how to save for college or how to save while at college, I’m here to help. During my time as an undergraduate student, I learned some tips and tricks along the way. Now, as a master’s student, I am perfecting the way I save money to pay for tuition, fees, and everyday living expenses!

The bottom line: understanding how to save money while in college is a good move.

Let's go through 5 of my tips, including a bonus tip!

This is most important when trying to save some extra cash. Think about your budget. Create a spreadsheet of your finances so you can see how much you have to spend each month. Excel should probably become your friend.

Include your income:

Scholarships and grants

Parental contributions

Jobs

Include your expenses:

Rent

Monthly groceries

Eating out

Activities/fun

Securing scholarships and grants is one of the best ways you can fund your education.

Unlike loans, where you will find yourself with student loan debt and potentially high interest rates, these do not require repayment.

Grants are primarily need-based, and scholarships can be need-based or merit-based. Learn the difference between the two. Apply for as many as you can find. I recommend starting with the FAFSA or the Free Application for Federal Student Aid to determine your eligibility for student financial aid.

When saving money in college, it’s vital to remember that less is more.

Trying to adopt a minimalist mindset can help your bank balance. We all are victims of impulse shopping. We should avoid getting into the traps of a materialistic culture.

By being more intentional about purchasing, you're much more likely to spend less. You may realize that you didn’t actually need the things you purchased. This can take some time—I still have difficulty with this!

Also, try thinking about being green and eco-friendly. This could mean turning down your thermostat and ensuring none of your devices is left on standby.

Not only are you helping the world, but you also get a fair share of savings. Try comparing water and electricity providers for a better deal. Also consider upgrading any particularly inefficient appliances.

A great way to save extra money in college is to take on an additional job alongside your studies.

Even after all financial aid is considered, you will still have some fees to pay out of your own pocket. So, getting a job with a steady income can ease financial stress. I took a job at my school’s museum as an attendant and tutored other students that brought in some much-needed extra cash. Look for these kinds of opportunities!

You can probably afford to spend 10 to 20 hours a week earning some side cash. And not only will it benefit you financially, but it can be a great resume builder. It shows employers you are hard-working and can balance an intense schedule. It also gives you valuable experience and a chance to gain contacts and networking opportunities.

Also, studies show that having a college job can positively impact your GPA. The US Bureau of Labor Statistics showed that students who worked 20 hours or less a week had higher GPAs than those who didn't work. I guess hard work pays off in more ways than one.

Do you know one of the most fantastic perks of being a student? Your student ID.

This card entitles you to discounts in various retail stores, restaurants, and institutions. Every time you purchase something, ask if there are student discounts.

It can also get significant reductions on tech products from Apple, Adobe, and Microsoft that you need for school. Use your discounts wisely and plentifully so you can get some significant savings. (I know I do!)

I saved over $10,000 on my bachelor's degree by taking courses at Outlier.org. Seriously.

It started during COVID-19 when all classes transitioned online. I found myself bored with the typical lecture format on Zoom, and I didn’t have the motivation that I once had for in-person lectures.

Then, an ad for Outlier popped up while I was browsing YouTube. It hooked me. I had been a fan of MasterClass and their engaging and masterful courses. And so it began.

Outlier gave me the opportunity to take exciting classes and learn from world experts while also contributing to my degree. Plus I saved over $1,300 per course. It was a no brainer! In the end, I took 7 courses at Outlier. My all-time favorite was the Intro to Astronomy course—probably because I am an astrobiologist, and I am a huge fan of Dr. Michelle Thaller who teaches part of the course!

By taking Outlier courses for transferable credit, you can also save anywhere from 50% to 66% on your college education. They even power an accredited online associate degree from Golden Gate University.

Now that you’ve learned several options for college saving, make a plan. Be consistent and follow through.

Outlier (winner of TIME Best Inventions 2020) and Golden Gate University (#1 school for working professionals) have redesigned the experience of earning a college degree to minimize cost and maximize outcomes. Explore a revolutionary way to earn your college degree:

College Success

Here’s an overview on saving money in college, why it is important, and 45 easy ways to do it.

Subject Matter Expert

College Success

This article overviews budgeting for college students, why it is important, how to create a budget, tools, and tips to save money.

Subject Matter Expert

College Success

If you need financial aid for college, it’s crucial to understand it. Learn what it is, how it works, the different types, and the steps in order to apply.

Subject Matter Expert