College Success

How To Fill Out the FAFSA [Quick Tips]

Here’s a quick and easy guide on how to fill out the FASFA form with easy-to-follow steps, tips, FAQs, and more.

Nick Griffin

Subject Matter Expert

College Success

04.16.2022 • 16 min read

Subject Matter Expert

The article provides a step-by-step guide that explains how to complete the FASFA, extra things to consider before applying, the most common mistakes to avoid, and more.

In This Article

Figuring out how to pay for college can feel like a completely overwhelming experience. Besides, there can be plenty of excitement and enthusiasm around other college-related tasks, such as choosing where to go to school, deciding on a major, and finding a place to live. However, putting financial obligations on the back-burner when preparing for school can be risky. One of the most important items to check off as you plan for college is completing the FAFSA (Free Application for Federal Student Aid). Knowing how to fill out the FAFSA and when are some of the many details we’ll cover in this easy-to-follow guide.

The process of finding money to help pay for college is streamlined thanks to the FAFSA, which helps you access federal student aid through the US Department of Education.

The FAFSA is an application created by the federal government that is used to determine financial aid for college students based on need. The information put into the FAFSA allows state and federal governments to disburse money to students by looking at the cost of education at your chosen school(s) compared to your family’s income.

By filling out this application, you will begin the process of accessing:

Federal and state grants

Federal student loans

Work-study opportunities

Scholarships

Taking the time now to complete the FAFSA early and educate yourself can save you thousands of dollars in the long run and a big headache down the road.

Yes, it takes time to fill out the FAFSA form, but this is time well spent and will really pay off later.

TIP - A good rule of thumb is to have the FAFSA done as early as possible and definitely before the start of the school year. You can submit the FAFSA starting October 1, 2021 up until June 30, 2023 for the 2022-2023 academic year.

Before we dive into the steps of how to complete the FAFSA, here is a good overview of the process from the Federal Student Aid Office of the US Department of Education itself:

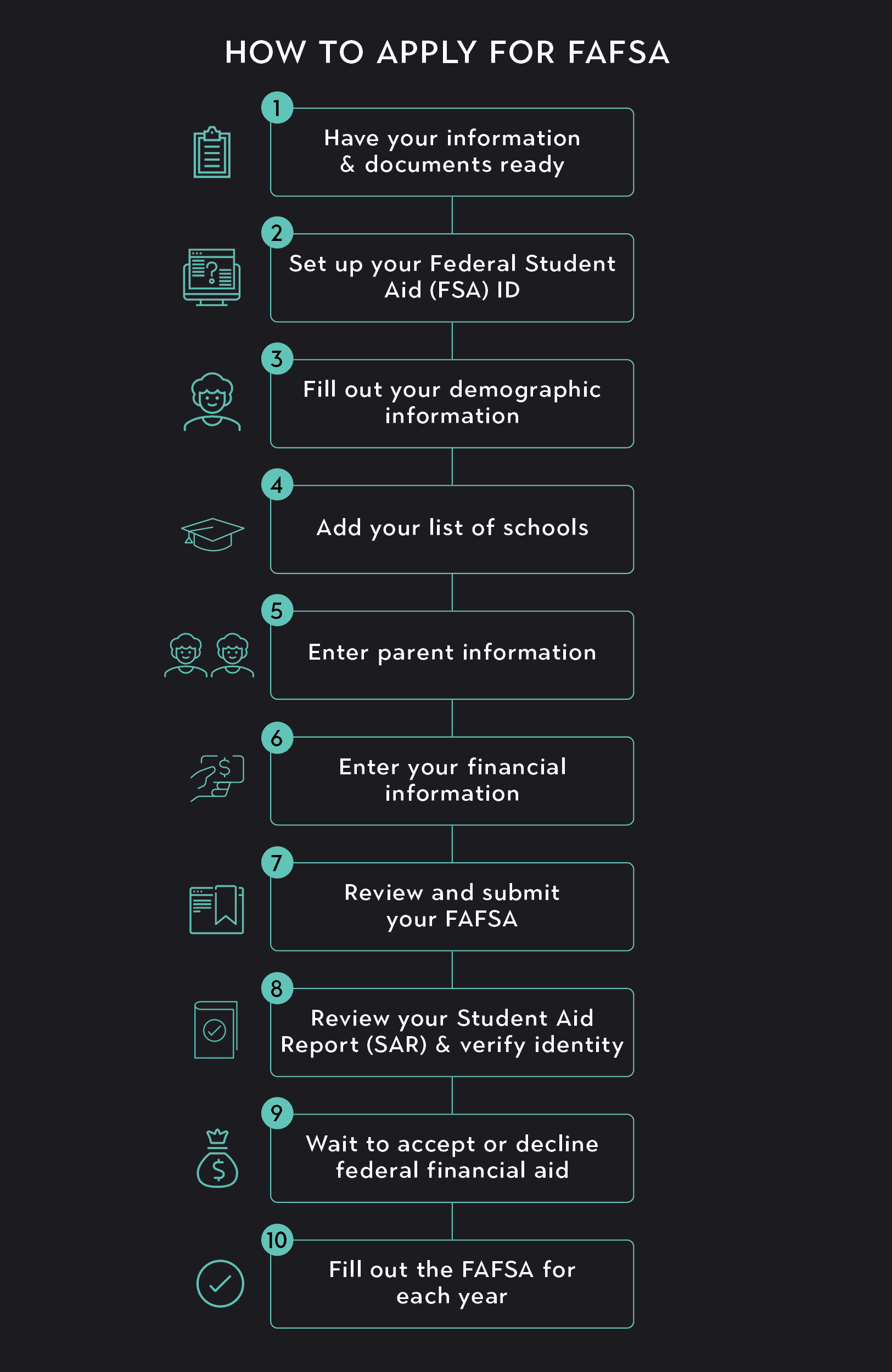

Here’s how to complete the FAFSA:

Your Expected Family Contribution (EFC) dictates the amount of money in financial aid you receive. The EFC is determined through the information you put on the FAFSA.

It can take as little as one hour to go through the FAFSA application process by having the following information available:

Your social security number or alien registration number

Your driver’s license

Family tax information (tax return) from the previous year

Current personal income information

Bank statements

List of colleges you’re applying to

Note: When it comes to tax information, you may be able to use the IRS Data Retrieval Tool. More on this in step 6.

To complete the FAFSA, you will first need to create an FSA ID. This is a unique identification number used to fill out the FAFSA. Each person—student or parent—will have their own FSA ID to log in and use the FAFSA website.

Logging on to studentaid.gov will prompt you to create an FSA ID before you begin the FAFSA. You can also do this through the myStudentAid mobile app.

The FSA ID is unique to each individual, even if a parent is helping with the application process, they will still have their own FSA ID. Although a parent is not required to fill anything out, you will have to input parent information (Step 4) into the FAFSA application.

Each year you complete the FAFSA, you will use the FSA ID. There is also a prompt for retrieving this information should you forget it the following year.

If this is the first time you are completing the FAFSA you will need to enter your personal demographic information. By demographics, the FAFSA is referring to your personal information such as your name, date of birth, social security number, etc.

It is extremely important that your demographic information be filled out exactly as it states on your social security card. By putting in information different from your social security card, you will not receive an accurate Student Aid Report (SAR).

If you are a parent helping a student fill out demographic information make sure you are putting the correct person’s information into each section. When you are on the student page, seeing “your” is referring to the student, not the parent. Check the banner to see which page you are viewing before inputting information.

Each year you can list up to 10 schools that you would like your FAFSA information sent to. These do not need to be schools that have already accepted you.

Each school will be put on the FAFSA by their federal school code. You can find this code in the application using the school section’s search tool. You can search for schools by selecting the state and entering the school's name. By listing several schools, you will find out how much aid you will get to attend each college.

Even if you are no longer a dependent of your parents, you must fill this section out, entering their names, addresses, and financial information.

Dependent students will qualify for less in student loans than independent students but still qualify for federal grants and work-study opportunities equally.

Students can change their dependency status if it has changed since their last federal income tax return. You must make these changes on the “Make Corrections” option on the FAFSA page or through your school’s financial aid office.

This section requires the financial information of your household.

The IRS Data Retrieval Tool (DRT) on the FAFSA website can fill in most information automatically. With this tool, you can securely transfer information from your federal tax return to the FAFSA form. If you are eligible to use this tool, you can locate the “Link to IRS” button in the finances section of the online form.

You’ll use your bank statements and tax documents to fill in the rest of the FAFSA questions. If your financial information has changed since last year, contact the school(s) you’re applying to and let them know.

Look over all the information you reported on the FAFSA thoroughly. There is language on the application that may be difficult to understand. Take your time and be certain that everything is correct.

Some states have their own financial aid form, and you may have the option to transfer FAFSA information onto your state form. This is a streamlined step that should be utilized.

Once you’re sure everything is ready, you will electronically sign and submit your FAFSA.

Once you submit your FAFSA, you will get a Student Aid Report within the next week. This report will let you know if there are errors that need to be fixed. The report will not include any financial aid decisions, only your EFC.

You can also log in to your FAFSA account and make sure it is processing. If there are errors that need to be fixed, do this right away.

Some students will need to complete a further identity verification process. Students are chosen randomly for this step. Be sure to complete the verification immediately.

Each school will let you know your total financial aid package for each year you complete the FAFSA. It is important to know your college costs upfront and create a budget that works for you.

Once you get your award letter, you can accept or decline your aid offer or accept a partial amount from each school you listed. Talk to each college’s financial aid office for assistance. The financial aid office is there to help you, so ask any questions you have.

Since the FAFSA needs to be filled out for each academic year, your financial aid award can change. As you go through school and figure out your spending needs, you may find a part-time job, or have significant life changes. This will affect your need of financial aid.

When you complete your FAFSA aid application for another year, remember to do it early.

Below is a list of upcoming 2022-2025 FAFSA dates:

| School Year | Tax Information Year | FAFSA Opens |

| 2022-2023 | 2020 | October 1, 2021 |

| 2023-2024 | 2021 | October 1, 2022 |

| 2024-2025 | 2022 | October 1, 2023 |

You can fill out the FAFSA once school has started since it has a 21-month window. You will not have these funds available to you at the start of the school year if you wait to complete the FAFSA.

While the FAFSA can help you access grants and loans to go to college, there is much more you need to know.

Learning how to manage your money while in school will benefit you for the rest of your life. Take the time to learn about paying for college by enrolling in Outlier’s free College Success course.

Through this course, you will learn valuable skills such as:

Accessing different types of financial aid

Increasing funds while in school

Minimizing costs on things you need

Evaluating your degree path and your potential earnings

The FAFSA does so much more than help you get student loans to pay for college. By filling out the FAFSA, you will also be applying for thousands of dollars in free money in the form of grants.

Grants are need-based funds that are available to students based on their EFC reported on the FAFSA. This money does not need to be paid back and you can use it for a variety of purposes such as tuition, fees, books, and even room and board.

When you fill out the FAFSA, you are not stating that you are going to enter a certain field or declare a specific major. The FAFSA is simply looking at the cost of going to your chosen schools compared to your financial resources.

When you fill out your FAFSA and declare up to 10 schools, all the choices are still yours to make. You can still pick your school and program as well as decide how much of the offered aid you want to accept.

Filling out the FAFSA gives you more knowledge and more options.

Even if you do not qualify for federal grants or work-study options, you may still be offered student loans. But how do FAFSA loans work?

Loans need to be paid back, with interest, but it is at a low rate set by the federal government.

The type of federal loan—subsidized or unsubsidized—depends on how your interest is calculated. Either way, these loans will have a much lower interest rate than any private loan from a bank.

The best part is that federal loans do not need to be paid back until after you graduate. Usually, there is a six-month grace period, giving you plenty of time to find a job and start working before starting repayment.

Dr. Kelley Richmond Pope of DePaul University explains more about loans in Lesson 3 of Outlier’s free College Success course. In this clip, she discusses the following:

Loans

Federal student loans

The pros and cons of interest

Compounding interest

Direct subsidized loans

Direct unsubsidized loans

Direct PLUS loans

Private loans

Even if you think your family makes too much money to qualify for financial aid, don’t assume. By filling out the FAFSA, you will know for certain if you qualify for aid and how much it could be. Remember, you do not have to accept it.

It takes time to:

Gather the information you need to fill out the FAFSA

Go through the application

Wait for the results

Decide what you need.

By filling out the FAFSA early, you will give yourself plenty of time to make decisions.

Since the state, local, and college agencies use the FAFSA to determine financial need, the earlier you get it done, the more aid available to you. This is where procrastinating could really cost you. (By the way, Lesson 2 of Outlier’s College Success course has some handy tips for beating procrastination, just in case you’re anything like us and could use some help in this department!)

Perhaps the most common mistake made on the FAFSA is putting in the wrong demographic information. It is of high importance to ensure that the student demographic information is what is put in the student section and not that of the parent(s).

If parent information is put into the student section and the FAFSA is submitted you could miss out on thousands of dollars in financial aid.

Be certain all information is correct before submitting the FAFSA.

By linking your demographic information on the FAFSA to your IRS financial information you save tons of time on the application process.

The biggest benefit of using the IRS DRT is that your tax information is completely accurate. This ensures that you do not make errors when putting in detailed tax information on the FAFSA application.

When about to put your financial information into the FAFSA an option button will pop up that says “Link to IRS.” You need to push this button and allow the FAFSA access to your tax information.

The FAFSA allows you to put up to 10 colleges on the application. It is wise to put down any school that you are even remotely interested in.

One school cannot see the other schools you listed on the FAFSA, but you can see all your financial options in one place. By listing multiple schools, you will know if you can get more money—grants, loans, work-study—to go to one school versus another.

This gives you all the information you need to choose the best school for your personal financial needs.

Keep in mind that you must complete the FAFSA for each school year. Since your financial situation usually changes from year to year, the amount of money you get could too.

It is important to take the time to fill out your FAFSA correctly every year you are in school.

Your school’s financial aid office is an amazing resource. Any questions you have, you can ask them.

Often students notice that their income situation has changed since last turning in tax information on the FAFSA. If this is the case, talk to the financial aid office. They will help you get the money you need for school.

The FAFSA helps you find money to go to school, but there are other aid programs out there too. (Also, take the time to educate yourself on the difference between scholarships and grants.)

By filling out both the FAFSA and outside resources, you open up thousands of dollars in aid that does not need to be paid back. Even local businesses may have scholarships available, find out.

Although minimal, there are some basic aid eligibility requirements to be aware of before filling out a FAFSA:

Be a US citizen or eligible non-citizen

Hold a high school diploma, GED, or certified homeschool equivalent

Not be in default of a current student loan or federal grant

Be enrolled above 50% part-time

As long as you meet these core criteria, you are eligible to complete a FAFSA. Since the information you put on the FAFSA is unique to you, it is important to understand how it relates to the financial aid you receive.

If you fail to meet your school’s academic standards, such as GPA or minimum credits per semester, you could lose your financial aid. In some cases, you may even have to pay the money back that was otherwise gifted.

As long as you take out the money you need and focus on your studies, the FAFSA will work well for you.

Make sure to talk to your financial aid office and be honest with them when issues arise. There are many resources that are available to students and underutilized.

As long as you have all the information you need ready to go, the FAFSA will only take about an hour to complete each year.

The FAFSA opens on October 1st to apply for the following academic year. Meaning if you want to start school in August of 2023, you can fill out the FAFSA on October 1, 2022.

The federal government gives students 21 months before the FAFSA deadline, but that doesn’t mean your school will accept it. A good rule of thumb is to have the FAFSA done as early as possible and definitely before the start of the school year.

If you are awarded federal grants, such as the Pell Grant, you do not need to pay this money back. Other types of grants, scholarships, and work-study funds do not need to be paid back either.

Any federal loans taken will need to be paid back, with interest starting 6 months after you graduate.

Subsidized loans are typically offered to undergraduate students. These loans don’t accrue interest while you are in school.

Unsubsidized loans are offered to graduate students and professional students primarily. An unsubsidized loan will start accruing interest as soon as funds are released. A wise student would pay the interest while in school so it doesn’t accrue too quickly.

Both types of loans do not require minimum payments until after graduation.

A PLUS loan is a third type that is offered to parents and students on top of their other loans. These loans are unsubsidized and have a higher interest rate.

Choosing to fill out the FAFSA is a wise choice, no matter if you end up taking out loans or not. By filling out the FAFSA, you will know your options when it comes to paying for school.

Even if you don’t qualify for free money such as federal grants, don’t worry, there are plenty of other options out there to help make school more affordable. Two possible options can be:

Scholarships. Make sure to look into scholarships as well. Most schools have an online platform they subscribe to that makes accessing scholarships easy. Talk to the financial aid office to find out if this is available to you.

Low-Cost Courses. Consider taking a semester of classes through a community college or an online program such as Outlier’s College Foundation certificate. This way you could earn transferable credits (in Outlier’s case, from the University of Pittsburgh, a top 60 school) at a fraction of the cost.

Take the time to do some research, and figure out what college is going to cost you in the program you want to do. Create a college budget and fill out your FAFSA each year. Be sure to keep in mind that you are making a future for yourself by getting your education. It’ll be worth it.

Outlier (winner of TIME Best Inventions 2020) and Golden Gate University (#1 school for working professionals) have redesigned the experience of earning a college degree to minimize cost and maximize outcomes. Explore a revolutionary way to earn your college degree:

College Success

Here’s a quick and easy guide on how to fill out the FASFA form with easy-to-follow steps, tips, FAQs, and more.

Subject Matter Expert

College Success

Get ready for college unlike anything you’ve experienced. Learn what it’s like to be a Degrees+ student. We’ll also break down the program and share tips from past students.

Subject Matter Expert

College Success

The article explains what FAFSA is, what it stands for, and its purpose. It also explains how it works and the different types of student loans.

Subject Matter Expert